Updated on February 4, 2023

Learn about our Editorial Process

It’s hard to escape the impact of cryptocurrency in today’s financial marketplace. Several attempts to create a decentralized currency have occurred over previous decades, dating back to the 1980s. In 2008, the crypto landscape changed when Satoshi Nakamoto (whose true identity is unknown) published a white paper regarding blockchain and Bitcoin that started a cryptocurrency trend that’s only grown stronger each year. As of November 2021, there are over 13,000 cryptocurrencies, with Bitcoin being the most recognized and traded.

Given cryptocurrency’s explosive growth in the past few years, investors are showing renewed interest. In fact, a growing number of individuals are even adding digital assets to their retirement portfolios.

To understand how cryptocurrencies impact the retirement plans of today’s workers, we surveyed 821 employees and over 203 financial experts. Continue reading to discover how workers feel about adding digital assets to retirement portfolios and when and how financial professionals recommend purchasing them.

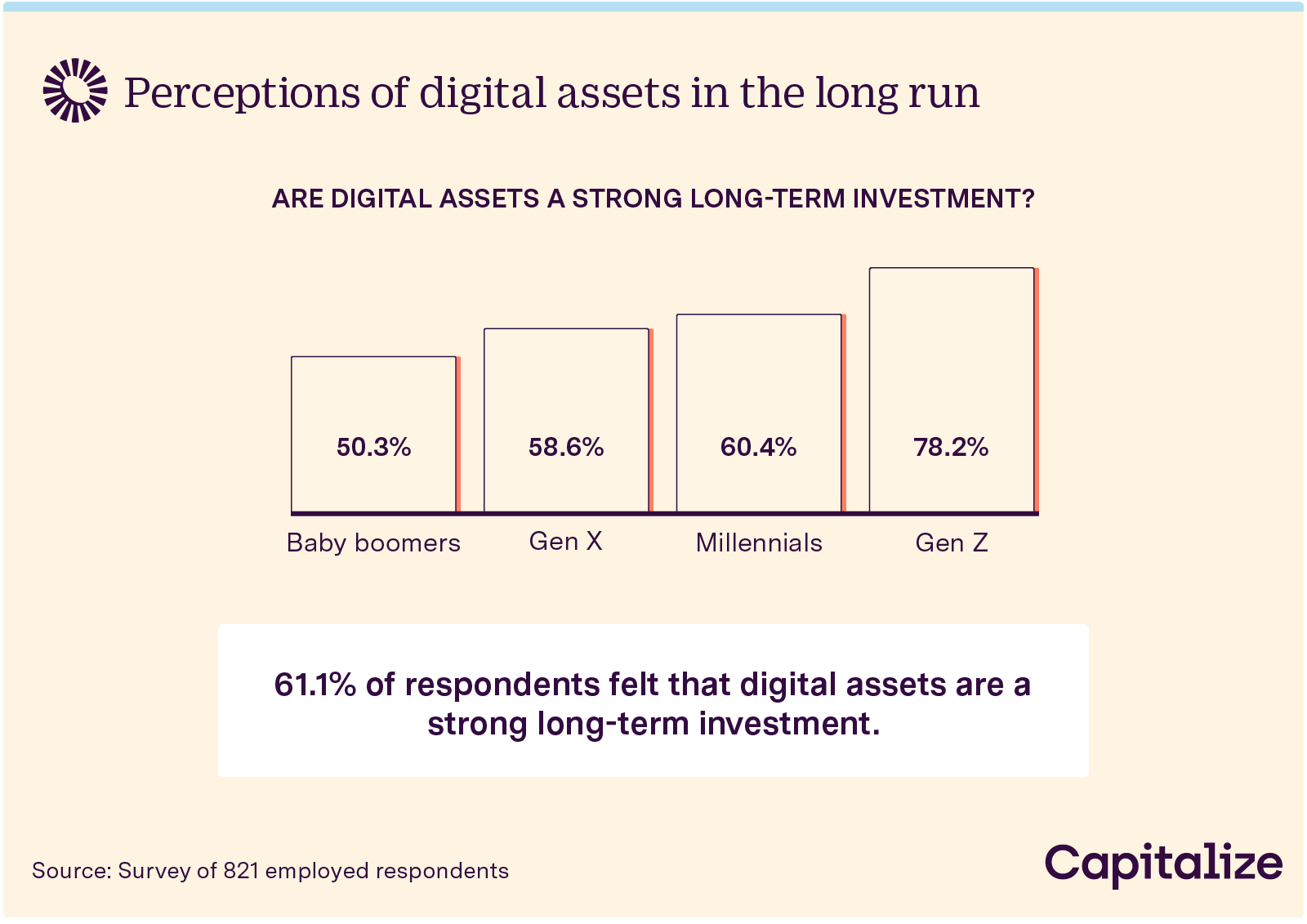

Over the last decade, individuals have become more bullish on crypto as a smart investment. Overall, 61% of respondents view digital assets as a strong retirement investment option, even though the majority view them as volatile investments.

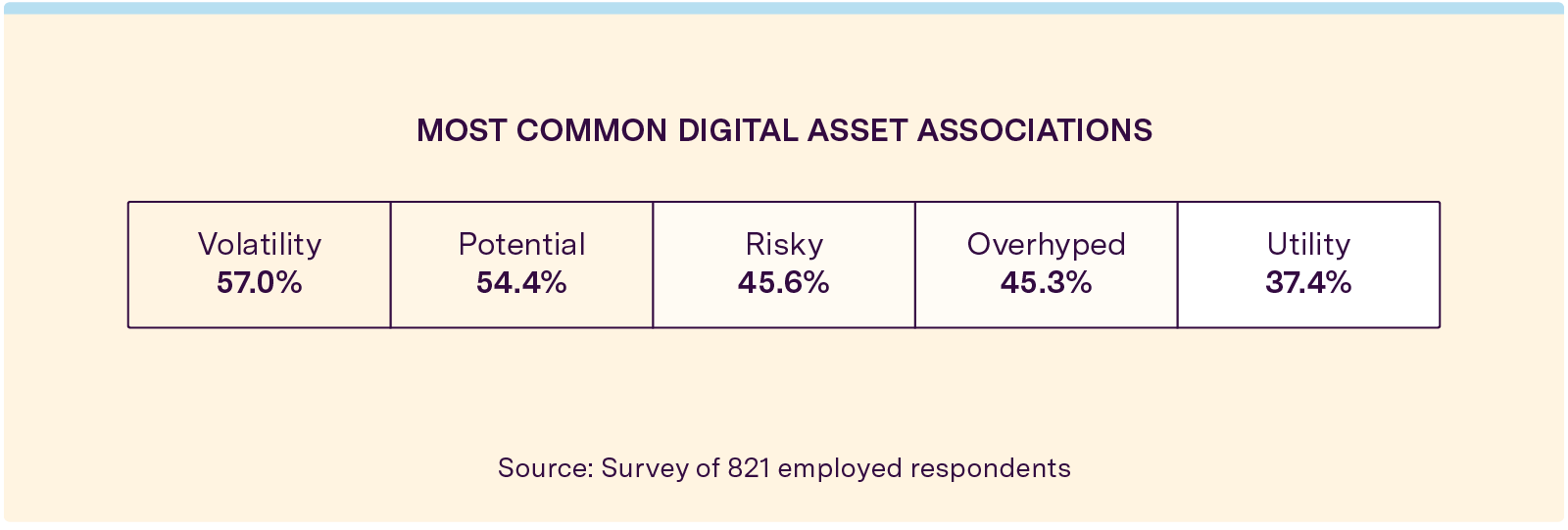

Retirement investors pay attention to volatility; the more time an investor has to save, the greater risk they can take. Workers approaching retirement tend to lean toward more conservative investment allocations and avoid volatile strategies that could quickly reduce account balances. According to the 821 employee respondents, 57% view cryptocurrencies as a volatile investment vehicle, with 45% viewing them as risky.

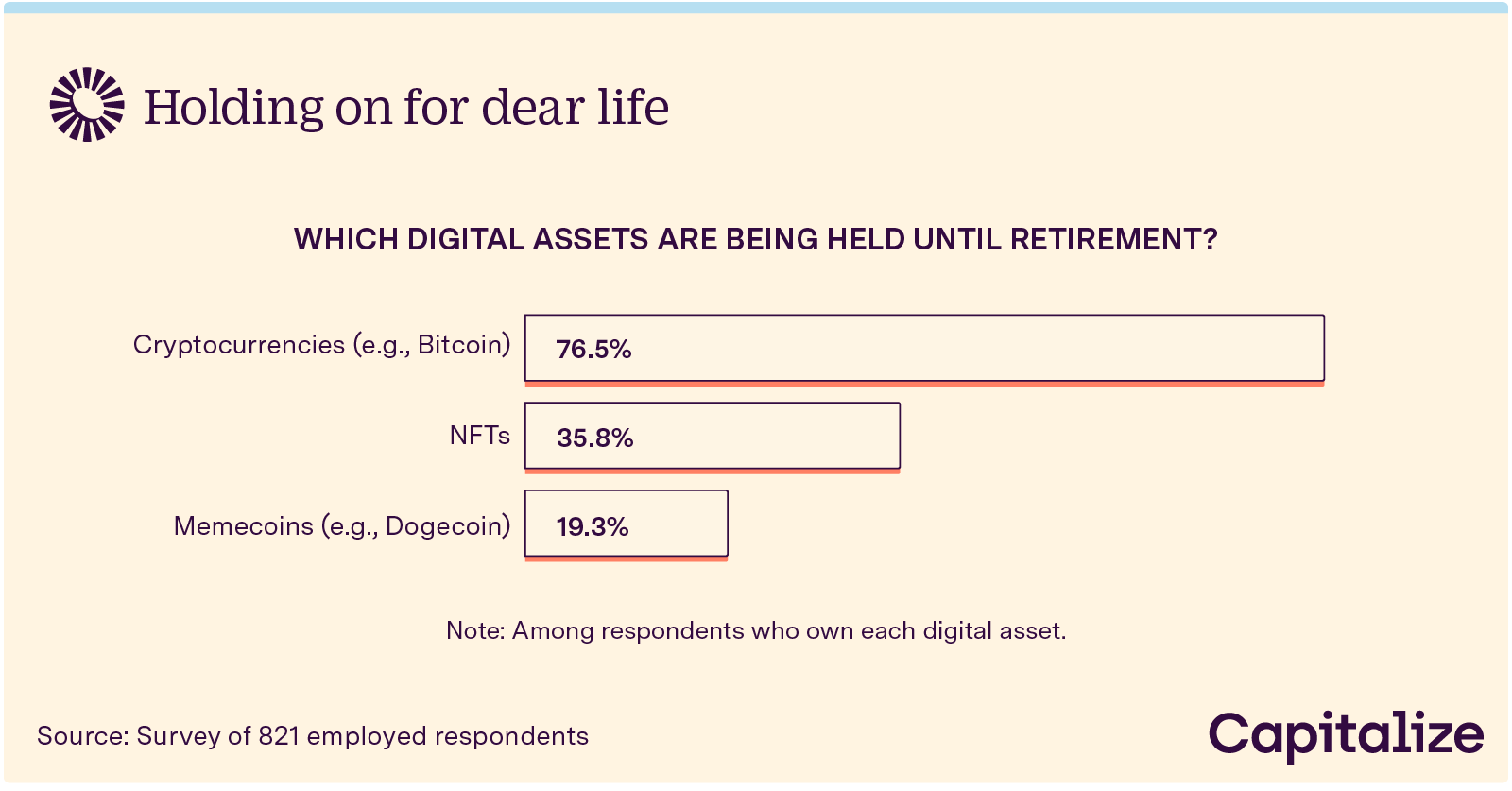

Other digital assets beyond cryptocurrency include nonfungible tokens (NFTs) and memecoins. NFTs are digital assets that represent objects in music, art, and even videos. Frequently purchased with cryptocurrency and often coded with software similar to cryptos, NFTs are unique—making them a popular method to acquire digital artwork. Memecoins, like Dogecoin, are heavily influenced by social media trends and typically fall under community-driven tokens inspired by cryptocurrencies. Both types of assets have begun to play a more prominent role for some when saving for retirement.

Financial advisers routinely advise clients who adopt a long-term investment strategy to not concern themselves with short-term market fluctuations. In that vein, most survey respondents investing in digital assets took a long-term approach. Over three-quarters reported purchasing cryptocurrencies they intend to hold until retirement. However, respondents weren’t showing the same confidence in NFTs or memecoins—only 36% and 19%, respectively, have plans to hold on to them for the long haul.

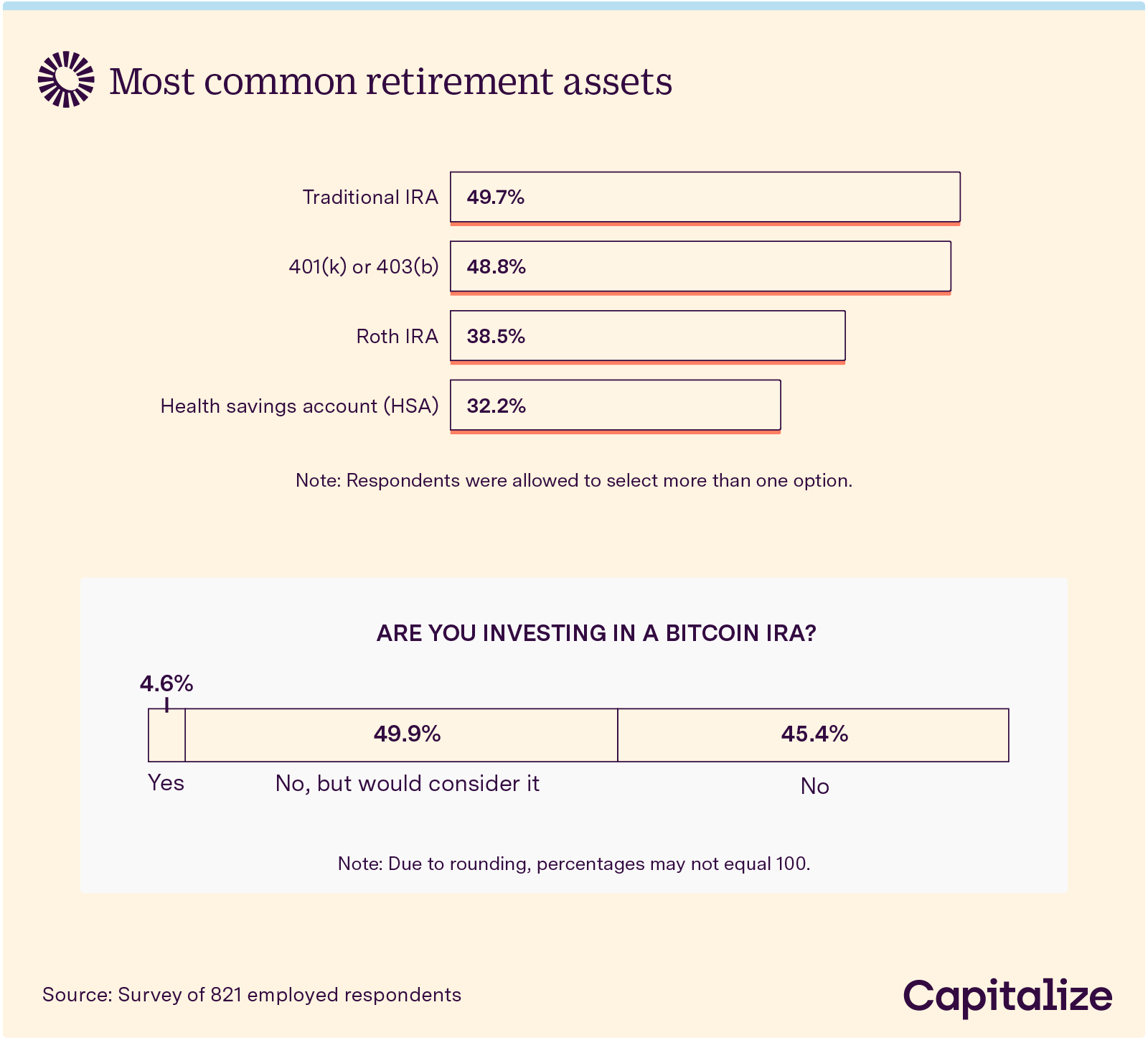

There are several ways workers can save for retirement. The most common are employer-provided plans such as 401(k) and 403(b) plans and individual retirement accounts like traditional and Roth IRAs.

Traditional IRAs (49.7%) top the list as the most popular retirement portfolio, slightly ahead of 401(k) or 403(b) plans (48.8%). Health savings accounts, on the other hand, are the least popular retirement investing plan, with less than 1 in 3 respondents contributing money to one.

In 2016, the company Bitcoin IRA began offering investors the opportunity to take advantage of tax-free earnings through a traditional IRA; the fund includes Bitcoin and other alternative currencies, including Litecoin and Ethereum. Now, more alternative IRAs are available than ever before (generally termed “Bitcoin IRAs”). That said, fewer than 5% of respondents are currently adding retirement dollars into a Bitcoin IRA entity. However, almost half would consider doing so.

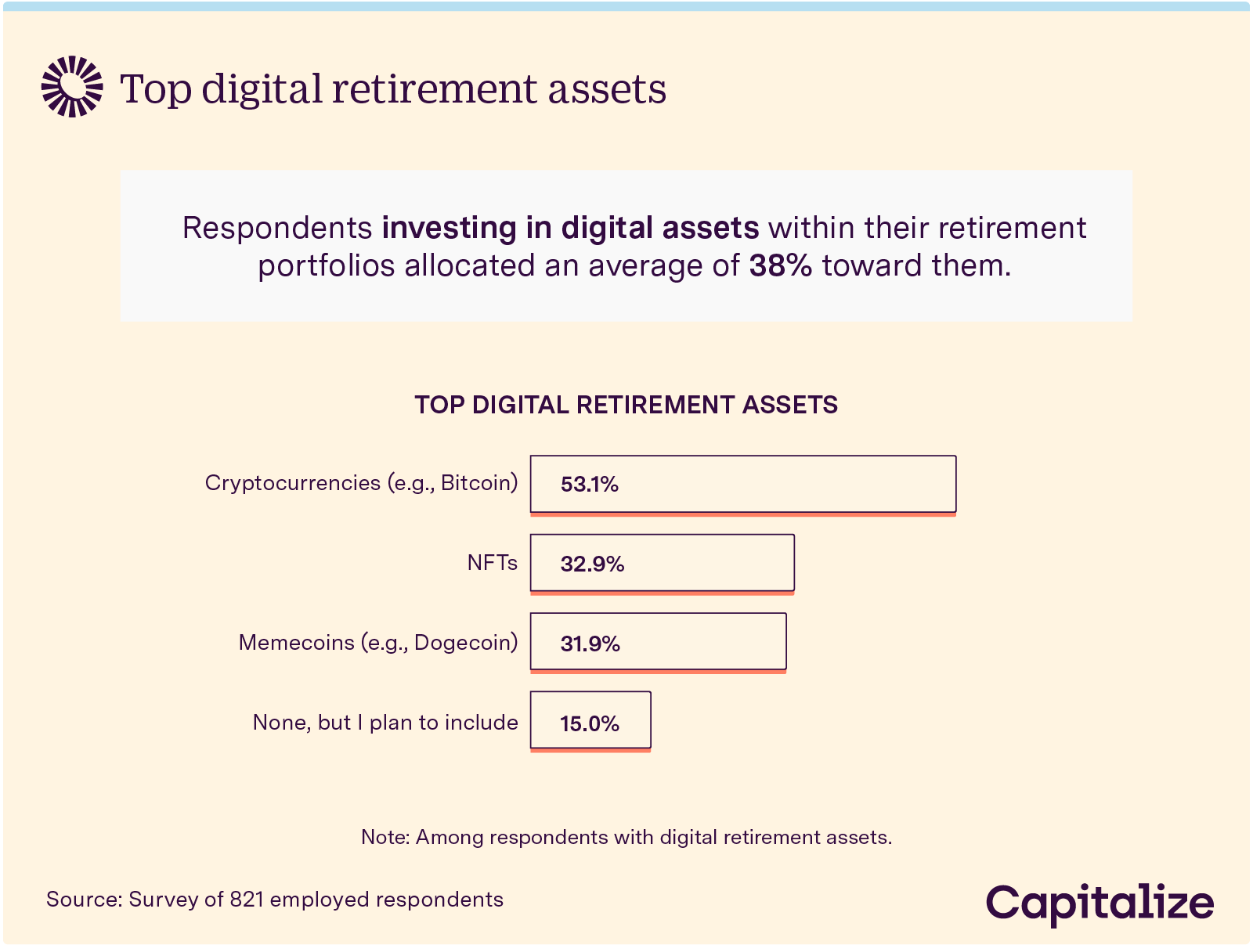

While some respondents aren’t on board with investing in digital assets at all, those who believe in the long term investment potential include them greatly within their retirement portfolios. Among respondents who currently invest in digital assets for retirement, 38% of their total portfolio is allocated toward this investment class. 53% of these respondents invest in cryptocurrency, and slightly less than one-third invest in NFTs or memecoins.

Additionally, 15% of respondents who aren’t currently invested in digital assets revealed they plan to do so in the future.

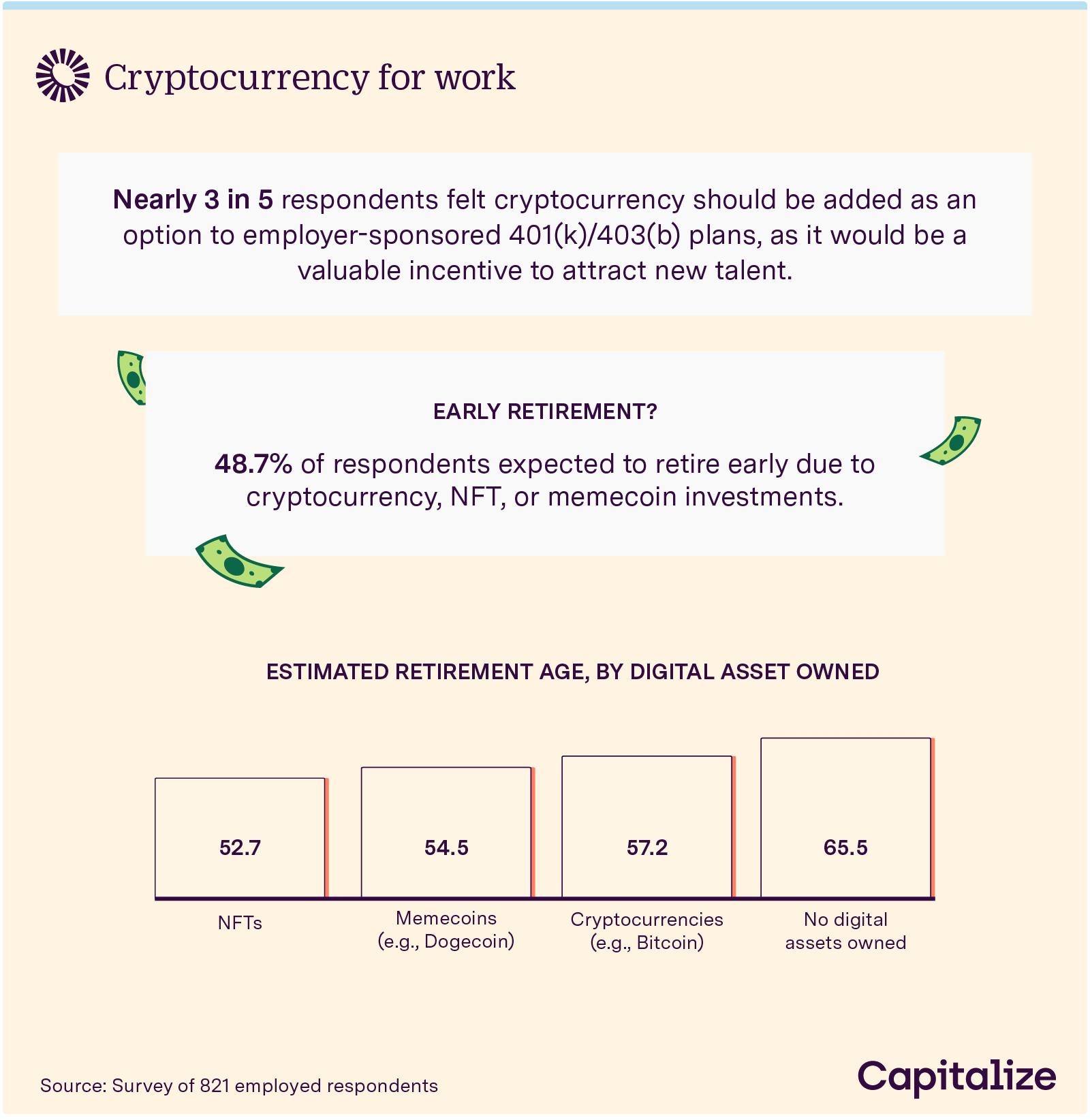

Until recently, no 401(k) plan offered employees the option of investing in digital assets. In July of 2021, 401(k) provider ForUsAll entered into an agreement with Coinbase Global, a leading cryptocurrency exchange, to give workers the option of investing up to 5% of their retirement assets in crypto. This may be just the beginning 一 some financial experts believe that more 401(k) plans will offer some form of digital asset as an option for investors. Nearly 3 in 5 survey respondents would like to see digital asset options added to their employer-provided retirement plans.

Interestingly, respondents who currently invest in digital assets in their retirement portfolios expect to retire 8 to 13 years earlier than those who don’t invest in them.

Of the 203 financial advisers surveyed, a significant percentage expressed a growing confidence in digital assets.

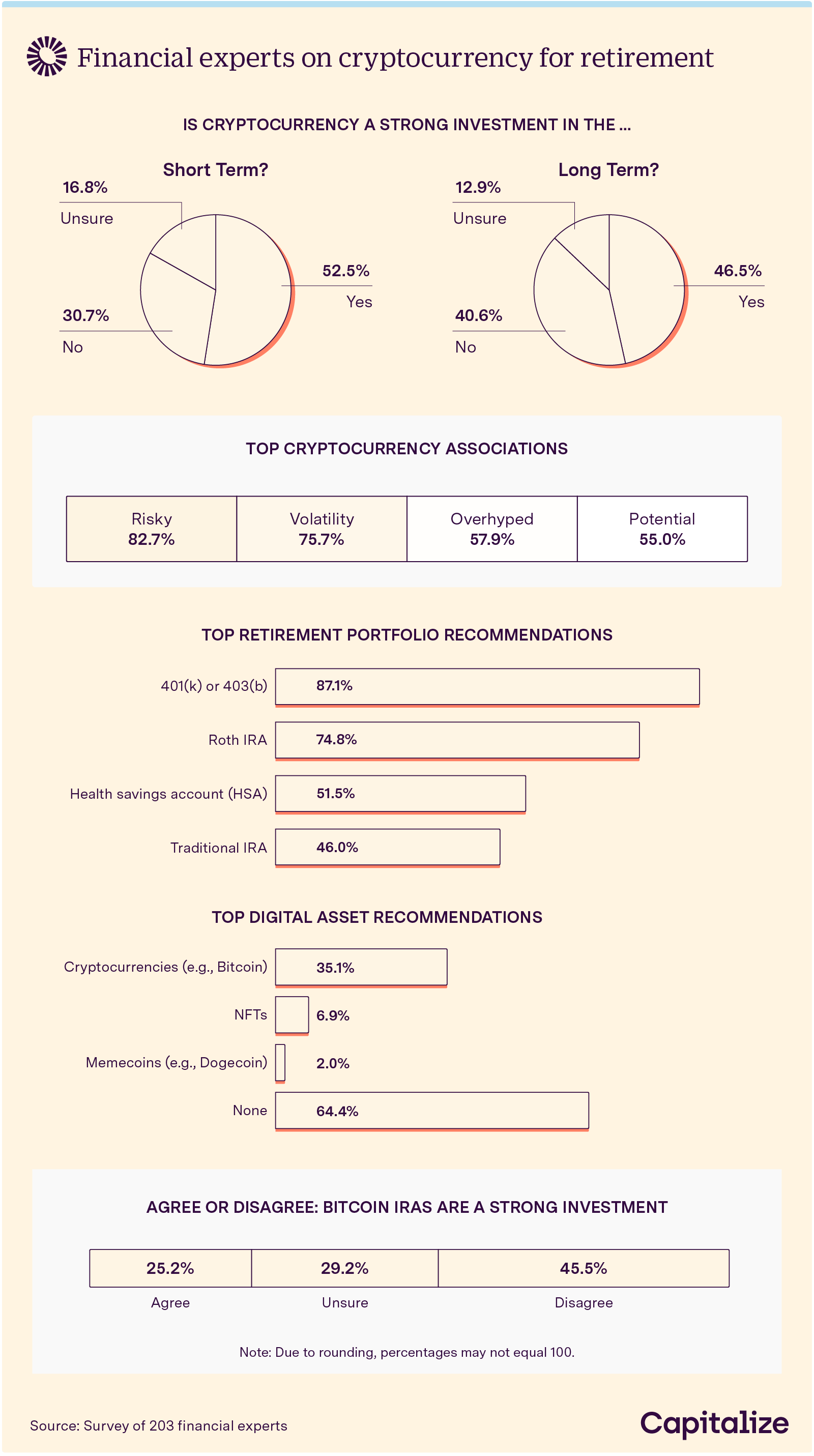

Financial advisers typically instruct investors to divide investments into short- and long-term categories. Over half of the financial advisers surveyed expressed confidence in crypto as a short-term strategy but were slightly less bullish on its long-term prospects. One issue involves the risk that advisers assign to digital assets. Over 80% placed cryptocurrencies in the “risky” category, with 76% considering it volatile. While 58% believe digital assets are ‘overhyped,” 55% still believe cryptos offer potential in retirement accounts.

When financial advisers did recommend digital assets, the most common were cryptocurrencies, at 35%. Alternatively, NFTs and memecoins garnered very few recommendations. Still, almost two-thirds of advisers wouldn’t recommend retirement investors allocate funds to any digital asset. As for whether financial advisers feel Bitcoin IRAs are a smart investment, 46% said no, with just 25% believing they’re a wise investment. 1 in 3 investors remain unsure. As there is less adoption and history behind Bitcoin IRAs, there could potentially be a rise in support from financial advisors in the future, mirroring their belief in cryptocurrency while reducing the likelihood for investors to cash out their retirement savings to invest in alternative assets.

Cryptocurrencies and other digital assets are changing the investment landscape, even for retirement accounts, and it’s helpful to know what your options are with a 401(k) when you change jobs. Regardless of what’s in your portfolio, Capitalize makes rolling over a 401(k) account easy, fast, and free. You can also easily find an old 401(k) if you’ve forgotten where your account was at. Learn how consolidating your accounts can help you save smarter over time.

For this study, we surveyed 821 employed respondents via Amazon MTurk and 203 financial experts via Prolific. 58.8% of employed respondents were men, 41.1% were women, and the remaining 0.1% reported as nonbinary. Generationally, 24.3% of respondents were baby boomers, 27.6% were Generation X, 27.4% were millennials, and the remaining 20.7% were Gen Zers. The average age of these respondents was 40.5 years old with a standard deviation of 13.7 years. 46.5% of financial experts were men, and 53.5% were women. The average age of these respondents was 34.6 years old with a standard deviation of 11 years.

The main limitation of this study is its reliance on self-report, which is faced with several issues, such as, but not limited to, attribution, exaggeration, recency bias, and telescoping.