Where to find your 401(k) statement

If you’re looking to better understand how to read your 401(k) statement, you’ve come to the right place! Continue on to deep dive into each of the pieces of information you might see on your statement.

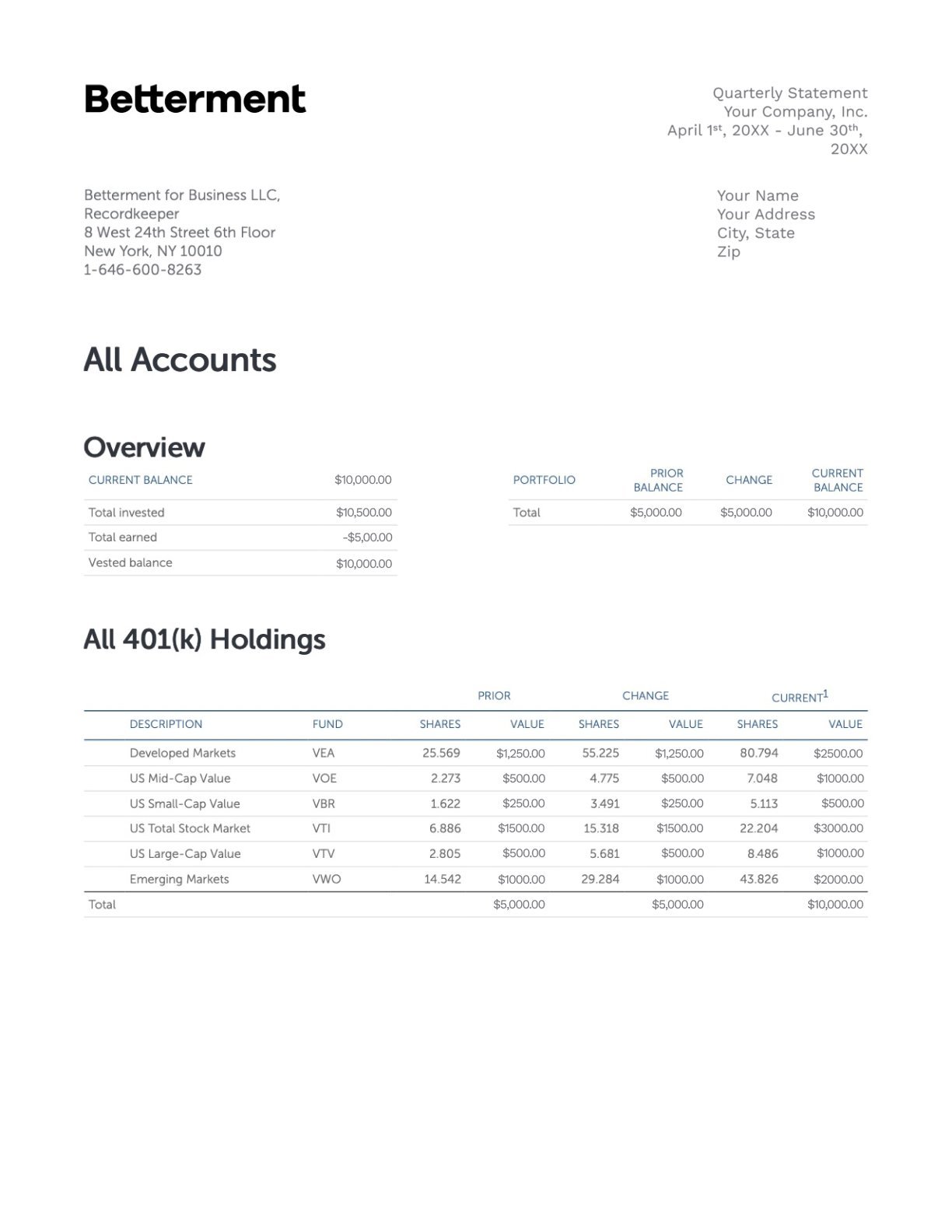

To find your statement, look for the place in your account where you can access Statements or Documents. We used an example from Betterment (scroll down to see it!), so your statement will likely look a little bit different, but you can use the same principles!

Understanding your balances

To start, you’ll probably see a few high level details about your account balances:

- Current balance: This displays the current value of the account.

- Change: This displays the gain/loss that your 401(k) has experienced, as well as the impact of any contributions or withdrawals. Historically, the stock market has gained about 7% per year, so over time the change in your account balance is likely to be positive. However, don’t expect this to be straight line growth! You should expect your account balance to fluctuate.

- Vested balance: This displays the amount of your total 401(k) balance that you would own if you quit your job today. Most companies that offer a 401(k) match also have a vesting policy: they reduce employee turnover by only fully rewarding their employees with their full match after a certain amount of service. Vesting policies usually lay out a percentage of match value per year that becomes vested (i.e. 20% after the first year of service). If you have an employer match and aren’t fully vested, your vested balance will be lower than your total balance – the difference is the amount of money you’ll leave on the table if you quit your job.

Understanding your holdings

Next, you’ll likely see a section that describes your 401(k) holdings overall. Here’s a quick breakdown of the important pieces of information for you to understand:

- Symbol, ticker, fund: This is the identifier for your holding. In a 401(k), the symbols you see will usually be 3 letters (for ETFs) or 5 letters (for most mutual funds). The symbol won’t tell you much about your holding, but you can easily type the symbol into a number of different tools (Google, Yahoo Finance, etc.) to learn more about it.

- Description or name: This is the full name of your investment holding, which will often give you clues about what types of assets the fund invests in. For example, you might see that your holding is exposed to international markets or perhaps to bonds.

- Shares: This is the quantity of the holding that you own. If you’re still contributing to this 401(k) account and to this holding, this value will go up each month.

- Price per share: This is the current price that a share of this holding could be bought or sold for. You should expect this amount to fluctuate.

- Value: This is the total value that you have invested in each holding. You can also calculate this value by multiplying the number of shares you own by the price per share. This amount will fluctuate as you contribute/withdraw and as the price per share of the holding fluctuates.